Business, Management and MBA Degrees

What Can I Do With a Degree in Business?

Find your perfect value college

According to the Bureau of Labor Statistics, some of the highest salaries with a bachelor’s level education are in business sector careers. Those stats just go up for MBA graduates in management positions – typically well over $100,000 in median pay. It’s easy to see that if you want to make money, business is the way to go.

Sure, there are stories of entrepreneurs who build up a company from the ground up with nothing but hard work, determination, and genius – no education. But those stories become well-known because they are so rare. For everybody but those special few, education is key to learning the ideas and skills to succeed in business. It’s also key to networking and making connections that will help build that business in the future.

Featured Programs

(check out: What’s the ROI of a College?)

A business degree can represent the cornerstone of a successful career or business. /a degree helps in just about anything that requires leadership, organization, and an understanding of how to make an idea work. For these and many more reasons, a business degree is an excellent thing to pursue.

Is a Business Degree Worth It?

Many people assume earning a business degree is hard because they assume that business itself is hard. Pursuing a business degree is no harder or easier than pursuing any other degree. Is a business degree hard? That isn’t the type of question to ask. Applicants interested in a business degree should, instead, wonder if they’re ready to earn their degree as they go after their goals.

There are several types of business degrees. Figuring out if a business degree is worth it will require applicants to also consider exactly what kind of business degree they need to achieve their goals.

For example, what is business administration and management? It’s a good question. While they both represent paths towards a business degree, they’re two different things. This can lead to further questions, such as: is business administration a good major? Is a business management degree good?

The benefits of studying business administration have the same weight as the benefits that come with studying business management. So, is business administration a good major? Absolutely. Is a business management degree good? Yes. A business management degree has a strong focus on planning, organization, and overall management. The benefits of studying business administration will allow students to focus on a business-related specialty, of which there are many.

In this way, applicants can think of business management as a more general business degree that fits into any situation.

A business administration degree is one that can help you take charge of a specific area of business. Is a business administration degree good? It’s a fantastic degree for those who know what they’re aiming for with their business degree.

The largest question that looms when it comes to a business degree: is a business degree worth it? The answer is yes. The best way to look at it is to consider the sheer versatility that comes with a business degree.

How Important is School or Program Accreditation When Choosing Business Programs?

When it comes to business degrees of any sort, accreditation is incredibly important. Accreditation shows the degree came from a legitimate and recognized institution or program. Business school accreditation also helps to choose the proper institution or program.

The accreditation status of a school or program means the program has been voluntarily submitted the school or program to a group for evaluation. Not all accreditation is good accreditation. This will depend on the group that sets the standards. Broadly, accreditation comes in two types:

- regional accreditation

- national accreditation.

Regional accreditation is sometimes called institutional accreditation. It comes from one of the seven groups recognized by the US Dept. of Education and CHEA. These groups set standards and give accreditation status to schools in their region of the country. This is why it’s called regional accreditation.

By contrast, national, specialized, or programmatic accreditation can come from an accrediting group that specializes in a type of:

- academic pursuit

- profession

- field.

These groups set standards that usually come directly from the industry the group represents.

The national or specialized accreditation groups often consist of luminaries in the field or people who have vast knowledge in a field of study. This isn’t always the case, which is why some national and specialized accreditation groups have higher standing and recognition than others.

For business school accreditation numerous groups accredit business programs and courses. Nevertheless, there are three main types of business school accreditation groups that offer the most prestigious business school accreditation statuses. For both bachelor’s programs and master’s programs, these three groups have the highest recognition:

- AACSB — Association to Advance Collegiate Schools of Business

- ACBSP — Accreditation Council for Business Schools and Programs

- IACBE — International Assembly for Collegiate Business Education

Even among these groups, AACSB accreditation standards have the highest consideration. Having AACSB accreditation means a business degree program meets the high standards set by the AACSB. Programs with this accreditation status offer a very high-quality education from a high-quality staff. This applies to:

- business degree programs in a traditional school

- AACSB accredited online undergraduate schools

- AACSB accredited online MBA programs

But, is AACSB accreditation important? AACSB accreditation standards serve as some of the highest and most prestigious. But there’s no absolute consensus that says an applicant needs a business degree with AACSB accreditation.

Because of the status of the AACSB, other accrediting groups often seem to stand in its shadow. However, IACBE accredited schools and ACBSP accreditation standards also are in high regard in business fields. Is ACBSP respected? Of course, this group is well respected. It’s worth considering a business program with their accreditation just as it’s okay to go with an IACBE accredited school.

Many people wonder if ACBSP accreditation is good or bad. In most cases, all three of these accrediting groups set standards that will ensure a good business education. Depending on your goals, you may even want to choose an accredited program other than the AACSB for your own reasons. You would do well to investigate each group and see what they’re all about if you’re on the fence about a group’s standards.

What are the Different Types of Business Degrees?

Applicants seeking a business degree may find themselves inundated with acronyms for the different types of business degrees available. There are a few things to consider for both bachelor’s and master’s degree choices. Here’s a look at the different types of business degrees at each level.

AA/AS: To get the quickest start in business, an associate degree takes only two years from a community college or college. That will get you into administrative and executive assistant positions. It will possibly allow you to progress into office management or human resource management. However, bachelor degree programs in those fields have made the associate less competitive in the job market.

(check out: What is the Benefit of Going to a Community College?)

BBA/BSBA: The main business degrees are Bachelor of Business Administration and Bachelor of Science in Business Administration. The bachelor degree is the basic entry-level education for:

- accountants

- financial analysts

- tax examiners

- other such careers

The bachelor’s degree most often takes 4 to 5 years of full-time education at a college or university.

MBA/MiM/MSM: The traditional standard for business master’s degrees is the Master of Business Administration. It’s still the most common business master’s. The MBA gives students a broad business education that is typically heavy on:

- economics

- accountancy

- theory

But in recent years, a desire for more specialized skills has led to more interest in the Master’s in Management and the Master of Science in Management. These are degree programs that focus specifically on:

- leadership

- human resources

- motivation

DBA: The Doctor of Business Administration, like the PhD in other disciplines, is the highest degree in Business Administration. It’s primarily earned by students who want to teach at the college level, or do academic research.

(check out: our Guide on Dual Degree Majoring)

Types of Business Bachelor’s Degrees

Here are some obtainable business bachelor degree types:

- BABA — Bachelor of Arts in Business Administration

- BBA — Bachelor of Business Administration

- BSB — Bachelor of Science in Business

- BSBA — Bachelor of Science in Business Administration

- BBM — Bachelor of Business Management

- BSBM — Bachelor of Science in Business Management

While all these different titles can seem confusing, you should understand that many of them are completely interchangeable. For example, the BSBM and BBM typically mean the same thing as far as coursework goes. A BS in business management will typically represent the same kind of degree no matter which degree type you choose. Many schools will even have different names for their BS in business management. However, it’s not an entirely different type of degree.

In most cases, what really matters is whether the degree program is for administration or management. After that, it matters if the degree in question is a BA or BS. However, it’s important to note that the BBA typically stands on its own as a degree. A BSBA is a variant of the BBA. Business administration subjects will likely remain similar between certain degree types. But, even with the business administration subjects, there is room for specialization, which is what the BS degrees are typically all about.

To avoid confusion, all you need to do is pay attention to each school’s description of their business program and look at the curriculum. BBA subjects encompass every business degree type because the BBA subjects are the broadest among the business degrees. That is to say, the BBA works as more of an overview of business administration rather than drilling down to a specific aspect of the field.

A BSBA degree will typically include more of the underlying subjects that move businesses, such as math and analytics. Any Bachelor of Science degree will have that kind of focus. By contrast, any Bachelor of Arts degree will have more of a liberal business focus. The BBA straddles the middle ground as it attempts to give a well-rounded education on all the aspects of business. BBA subjects will play a major role in any other type of business degree program.

The BBA scope encompasses everything you need to work in the business field. Nevertheless, the BBA scope doesn’t always concern the best practices for a specific area of business management or business administration.

A bachelor’s in business management and a bachelor of science in business administration will have a lot of crossover as far as coursework goes. Business administration courses tend to follow similar paths. Business administration courses will not vary significantly between degree types.

A bachelor’s in business management will contain many of the same classes as a bachelor of science in business administration. The major difference is that a bachelor’s in business management will come with more of a focus on management and leadership. A bachelor of science in business administration will start to veer towards specialization.

To know just what you’re is getting into, with the different business degree programs, just look at the subjects list. The business administration subjects list will contain the information necessary to figure out which direction that business administration degree is going in.

Business administration degree requirements and business administration classes will have comparability to other types of business degrees as well. Your best course of action when choosing the type of degree program you want is to decide on your goals. Then look at the classes and subject lists to find the ones that will help your reach those goals.

Types of Business Master’s Degrees

An MBA works a little differently than the bachelor level. There is a lot you can do with a bachelor’s degree in business, which can make you wonder if an MBA is worth it. Well, is an MBA worth it? The answer to that will, as usual, depending on your goal. However, in most cases, an MBA is worth it.

An MBA allows for a deeper level of specialization. The degree can also open the way towards corporate titles and other career levels that aren’t easily attainable if you just have an undergraduate degree. If the question is what can I do with an MBA, then the answer is, what can an MBA do for you? Really, what can an MBA do for you includes virtually anything you want. However, earning the MBA is ideal if you want to advance in the field or want to do more like entrepreneurs.

Before seeking out the top MBA programs in the world or the best universities for MBA degrees, you must recognize what pursuing a graduate degree might mean in your life. For example, many people are already supporting themselves before they start looking at the list of MBA programs to see what might work for them. Luckily, there are top part-time MBA programs. The best part-time MBA programs will allow you the flexibility to achieve their goals without sacrificing their livelihoods to do so.

When seeking the top MBA programs in the world, you must know what it is you’re looking at. Some of the best universities for MBA degrees will have a plethora of degree options. Look at any list of MBA programs. You might see numerous MBA accredited programs don’t all have the same type of goal or focus.

For example, for those looking for the best part-time MBA programs, there are PMBAs, which are part-time MBA programs. On the other hand, you may want to earn your degree quickly. Instead of looking for the top part time MBA programs, you will want an MBA program comparison that lists faster degree programs. For example, that MBA comparison list may show:

- accelerated MBA programs

- 1-year full-time MBA programs

- other options that can allow you to move quickly towards your degree

The best MBA programs in the USA and the best affordable MBA programs in the world aren’t always the best ones for certain applicants. MBA accredited programs vary greatly around the country and the globe. You should look for the best affordable MBA programs in the world, but you should do so understanding that affordability is relative to other cost factors when it comes to choosing an MBA program. MBA programs in the USA can exist at any type of school, college, or university. The best MBA programs in USA can also exist online.

Choose your MBA program carefully based on your needs and goals.

What About Online Business Programs?

Because of their popularity, business degrees are available through online programs at all levels, from AA to DBA. But whether an online degree is right for you is another question. An online program requires students to be:

- self-motivated

- confident

- comfortable with technology

In exchange, you get a degree by a means that is convenient and flexible, It allows working adults and part-time students to manage their education on their own schedules and at their own pace

(check out: Are Online Degrees a Good Investment?)

There are still significant advantages to residential degrees in business. However; many successful business people will attest that life-long connections are made in school. Networking is one of the keys to business success. However, the best online business programs are working on innovative solutions to the problem of relationship building, including:

- cohort programs (in which the same students take courses together through the entirety of their education)

- on-campus orientations

- other means of connecting students in meaningful ways even if they are not together on a traditional campus

Both bachelor’s and MBA programs exist online. An online bachelor’s in business is comparable to any other type of business degree program. Some of the best online MBA programs are online.

Online MBA courses are no different than business courses found elsewhere. Make sure the program offers an accredited online business management degree or any other type of business degree.

The accreditation of the program is what sets it apart. The best online MBA programs will have a good accredited status. Accredited online MBA programs are plentiful. Just make sure the accredited online MBA programs you choose adheres to the standards set by one of the main business accreditation groups.

When is an online MBA worth it? Having an easily accessible online option can help make that pursuit worth it. This is all equally true for those who may want to pursue a business administration online degree or an accredited online business management degree.

Best Value Residential Programs

Top 50 Best Value Undergraduate Business Programs

Top 25 Best Value Master’s in Management

Top 20 Best Value Packaging Programs

Top 50 Best Value MBA Programs

Top 50 Best Value Project Management Certificate Programs

Top 50 Best Value MPA Programs

Best Value Online Programs

Top 25 Best Value Online Master’s in Management Programs

Top 50 Best Value Online Accelerated MBA

Top 50 Best Value Online MBA Programs

Top 50 Best Value Online Bachelor’s of Emergency Management Programs

Top 50 Best Value Online MPA Programs

Top 50 Best Value Online MBA/Healthcare Administration

Most Affordable Programs

Top 10 Most Affordable Online Master’s in Organizational Leadership

Top 10 Most Affordable Online Associate’s in Accounting

Top 10 Most Affordable Online Graduate Programs in Accounting

Business School Graduates: How Much is a Masters in Management Salary?

Financing Education

Paying for a college education can be complicated. There are:

- tuition

- fees

- textbooks

- living expenses

Most students today take student loans for granted, and they are still the main way that students pay for a higher education. Federal loans and private loans have their advantages and disadvantages, including:

- varying interest rates

- repayment plans

- the amount you can borrow

But there are plenty of other ways to finance your education that don’t have to leave you in debt. The Free Application for Federal Student Aid (FAFSA) is the first step. This will determine your level of financial need for federal Pell Grants. Pell Grants do not have to be repaid. Neither does money earned through the Federal Work Study program. Here, students work for the college or university in exchange for tuition money. And of course, scholarships do not have to be paid back either, whether need-based, merit-based, or some other form.

(check out: Top 25 Tuition Free Colleges)

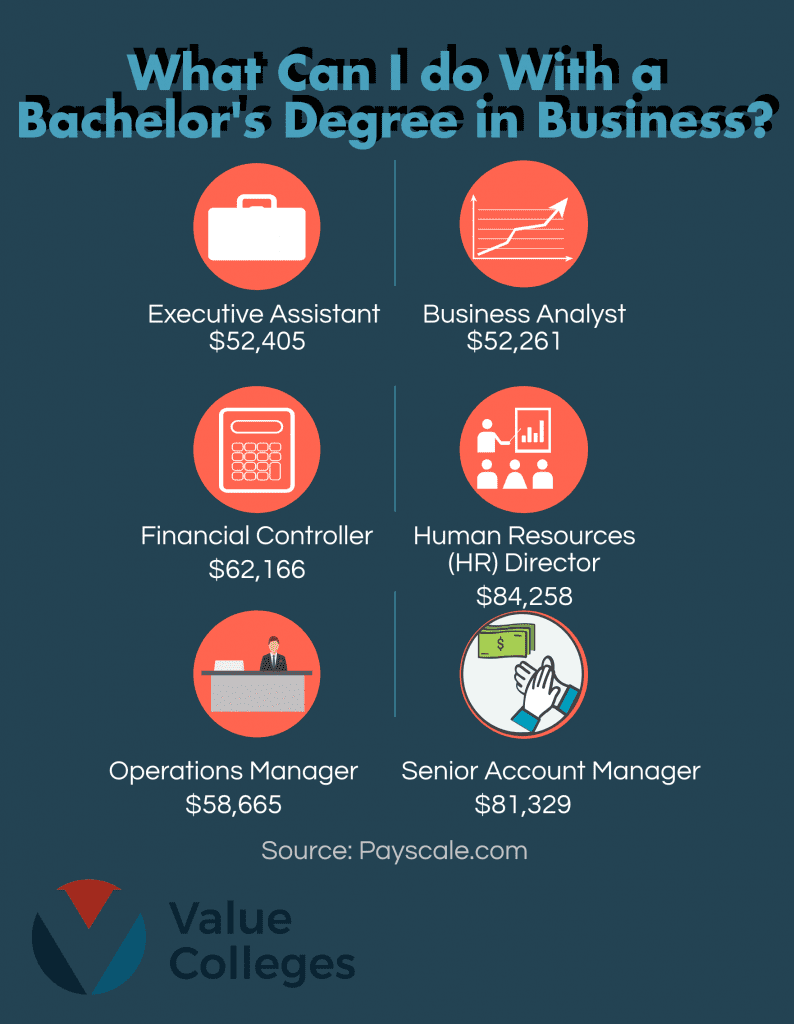

What Are Some of the Possible Careers in Business?

Careers in business are plentiful. With a business degree, a tremendous amount of career options open. With an MBA, those career options only multiply.

Careers in Business with an Undergraduate Degree

Business administration degree jobs and bachelor’s in business jobs exist in all sectors. In addition, applicants need not search for business administration degree jobs or bachelor’s in business jobs specifically. The business degree itself lends itself well to myriad jobs, positions, and careers that aren’t necessarily in the field of business.

If you were to look at a business administration jobs list, you would likely find many employers who are happy to hire someone for positions in management, sales, administration, or anywhere else. This is because a business degree is robust enough to encompass practically any aspect of a business. Bachelor’s in business administration jobs you shouldn’t worry you cannot find work with your degree.

A business administration jobs list may show BBA degree jobs as well as career opportunities in other sectors. For example, a business administration job description can include careers in:

- Development

- Human resources

- Management

- Sales

- Statistics or logistics

Some positions listed may not seem like bachelor’s in business administration jobs, but they are. If a job requires management, then it’s a prime example of BBA degree job. Every business needs management. So every business potentially represents bachelor’s in business jobs or bachelor of science in business jobs. When you’re looking for “business administration jobs near me,” you would do well to remember that your degree gives you access to far more than just business management degree entry-level jobs.

Careers in Business with a Master’s Degree

Jobs with an MBA degree include all the job and career paths offered at the bachelor’s degree level, with many more opportunities and career advancement potential. Many of the entry-level MBA jobs are mid and upper-level tier jobs for those with undergraduate degrees.

Careers for MBA graduates include:

- higher leadership positions

- titled corporate positions

- better entrepreneurship endeavors

For example, someone with a BA can become a manager or part of a management team. Careers for MBA graduates can include things like:

- management consulting

- management training

- management development

Even entry level MBA jobs often come with titles unobtainable by those with an undergraduate degree.

What are the job opportunities after MBA attainment? Many people wonder how to get a job after they’ve earned their MBA. This is especially true for those who went straight for their MBAs and are looking for the best jobs for MBA graduates with no experience. The good news is that entry-level jobs for MBA graduates are plentiful.

As previously stated, those looking for the best jobs for MBA graduates with no experience will have the education to choose from any of the undergraduate degree jobs just to get their feet off the ground. What are the job opportunities after MBA? Entry-level jobs for MBA graduates can include things like:

- Financial analysts

- Investment analysts

- Marketing and sales management

- Product managers

A lot of the jobs for recent MBA graduates have specialties. As an MBA graduate, you likely chose a specialty. So you’re ready to enter the field with that concentration. However, entry level jobs for MBA graduates don’t have to be in your specific field of study.

If you have an MBA and no experience you should know that practically any business-related position is open to you. Nevertheless, the highest paying jobs for MBA graduates will typically need graduates to:

- go through some training

- gain some additional experience

- work in a specific niche

The highest-paying jobs for MBA graduates will also depend on location, demand, and several other factors.

Got a knack for numbers-crunching? According to BLS, an Accountant can make over $63,000 annually. With only a four-year degree as the requirement, that’s a solid value choice for those looking for a high ROI major. A business degree can lead to many exciting choices not just the typical corporate positions like financial analyst, human resource specialist, marketing, management.

How about becoming an entrepreneur? Remember to rake up those contacts in college, become a networking king or queen and have the Linked-In account to prove it- then launch your amazing start-up concept!

What is the Salary Potential for Business Degree Graduates?

Business administration salary potential is good. This is also the case for entry-level MBA salary and beyond. Salary can vary widely based on numerous factors. Those factors can include:

- location

- demand for a skill

- the market a business operates in

- experience

- various other things

Still, there are a few averages and medians available to show what a business administration degree salary can look like.

For example, PayScale lists the average business administration salary across the country as $61,000. This number is only an average. It stretches across several different types of business administration jobs and other positions available to those with a business degree. Because these are averages, there’s also the potential for business administration degree salary to rise above the $100,000 mark.

In addition, a bachelor’s in business administration salary for someone working as an IT manager isn’t the same as a BA in business salary for someone managing operations at a local store chain. Companies matter as well. Larger corporations tend to pay more because they can afford to pay extra for talented business majors. Applicants must keep all these points in mind when seeking bachelor’s in business administration salary comparisons.

What is the business administration salary compared to the entry-level MBA salary? In most cases, the same rules apply when seeking MBA entry-level jobs salary that applies when seeking BA in business salary numbers. Nevertheless, a bachelor’s in business salary is almost always going to sit lower than even the entry-level MBA salary.

To put this in perspective, PayScale also lists the average MBA salary at $86,000. Of course, the highest paying MBA specialization will have a salary several times greater than entry-level MBA with no experience salary.

Related Rankings:

- Top 50 Best Value Undergraduate Business Schools

- Top 50 Best Value Online Undergraduate Business Schools

- Top 50 Best Value MBA Programs

- Top 50 Best Value Online MBA Programs

- Top 50 Best Value Accelerated Online MBA Programs

- Top 25 Best Value Executive MPA

- Top 25 Best Online Masters in Accounting Degrees

Featured Programs

Aya Andrews

Editor-in-Chief

Aya Andrews is a passionate educator and mother of two, with a diverse background that has shaped her approach to teaching and learning. Born in Metro Manila, she now calls San Diego home and is proud to be a Filipino-American. Aya earned her Masters degree in Education from San Diego State University, where she focused on developing innovative teaching methods to engage and inspire students.

Prior to her work in education, Aya spent several years as a continuing education consultant for KPMG, where she honed her skills in project management and client relations. She brings this same level of professionalism and expertise to her work as an educator, where she is committed to helping each of her students achieve their full potential.

In addition to her work as an educator, Aya is a devoted mother who is passionate about creating a nurturing and supportive home environment for her children. She is an active member of her community, volunteering her time and resources to support local schools and organizations. Aya is also an avid traveler, and loves to explore new cultures and cuisines with her family.

With a deep commitment to education and a passion for helping others succeed, Aya is a true inspiration to those around her. Her dedication to her craft, her community, and her family is a testament to her unwavering commitment to excellence in all aspects of her life.